Source: Property Investor Today

Date: 07 September 2016

By Raj Debperty

URL: https://www.propertyinvestortoday.co.uk/breaking-news/2016/9/uk-property-market-looks-ripe-for-investment

UK property market looks ripe for investment

They say no man is an island, however the UK is – and there is only so much land available, says Raj Deb, CEO and founder of Seed Property Consultants, who explores current industry trends and shares his thoughts on the main considerations for property investors and what the housing sector will look like in ten years time.

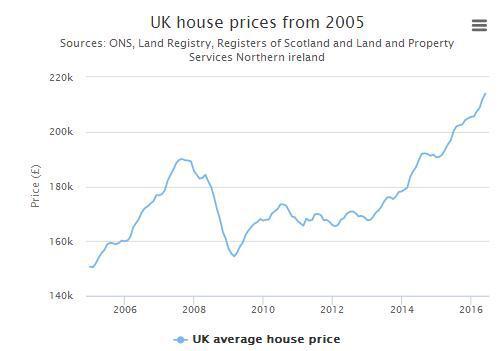

The UK is currently in the depths of a housing crisis, yet the opportunities abound for the smart investor. Significant population growth generated by increasing birth rates, immigration,low wages,lack of government investment, limited space and most recently Brexit, have all had a part to play. However, despite the current picture, house prices are still anticipated to rise, albeit at a slightly lower rate due to Brexit.

Key industry considerations: In the current climate

As obvious as it may sound, the key factors currently faced by the property sector can typically be split into two main categories: (1) more immediate and (2) longer term.

More immediate considerations currently shaping the industry include:

+ Lack of available space

Greenbelt policies, local pressure groups and environmental issues often prevent land from being developed where it’s most needed, this leads to a squeezing of opportunity for housing developments.

+ Population trends

More people with the same space! Increasing population size is only adding to the problem. Population is impacted by a number of factors. Birth/death ratesandimproved medical science has resulted in more births and longer life spans. Immigration is a sub-set, not only are adult numbers increasing, but the emergence of affluence and safe havens has alsomeant births are increasing too.

+ Housing shortage

Research shows that the UK needs a minimum of 240,000 homes built per year in order to meet demand. In 2014, less than 120,000 properties were built and lack of investment by successive governments has made the problem worse. Another more recent social factor is the rise ofmore single occupancy households. Remaining single for longer is at one end of the spectrumwhile divorced singletons are at the other. This has resulted in occupancy density levelsand numbers of available dwellings decreasing.

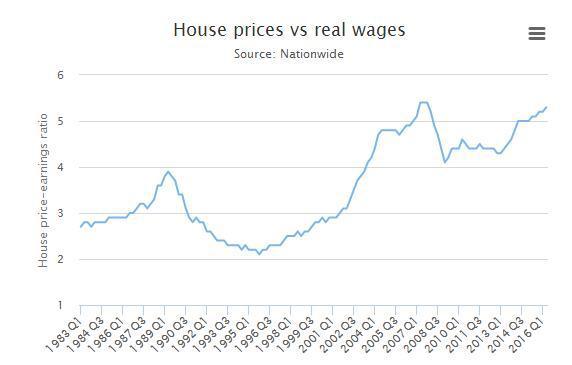

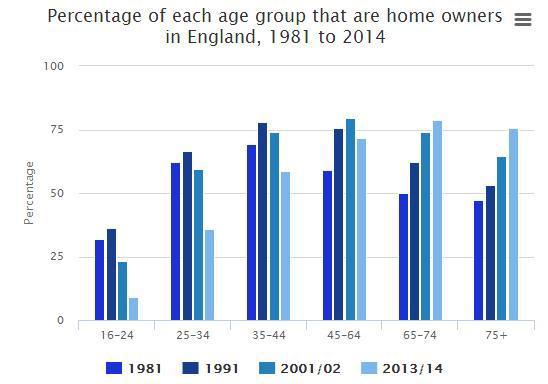

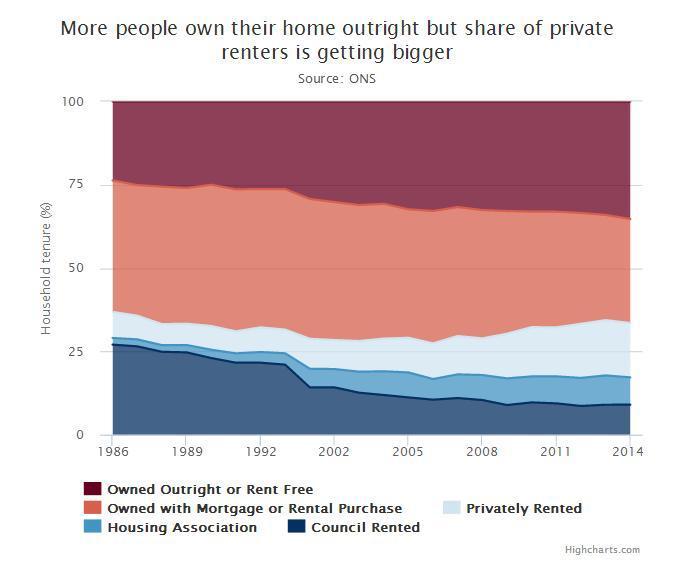

+ Low wages

Since 2008, when the most recent recession hit, wages have remained low, even decreasing for the vast majority of workers.The lack of disposable income has meant the practice of getting a mortgage is not as popular as it once was.In fact, what we are now seeing, is a move away from Thatcherism’s ‘buy your own house’ edict towards the more European ‘rent first and buy later in life’ outlook.

+ Brexit ripple effect

The shock waves from this unexpected political bombshell are still reverberating and with talk of the process of leaving the EU not starting until 2019, this remains a relative unknown.However, in or out of the EU, Britain still undoubtedly remains an attractive country in which to live.

Key industry considerations: For the next decade

+ Green belt land and laws

As space runs out,it’s hardly surprising to hear there are calls on all sides for current greenbelt principles to be re-evaluated.Some want stronger protections to help meet the challenges of climate change and food security. While others question how areas of the greenbelt, without public access and/or high environmental value, can continue to justify protection.

In the next ten years, it’s highly likely we’ll see a relaxation in laws and an overall reduction in green belt land, which will increase the amount of land available for development. However,rather than simply filling the space with large individual houses with significant gardens (like those built during the 1940s to 70s), we’ll see an influx ofnew-builds comprising multi-occupancy flat blocks and smaller proportioned houses.

+ Housing shortage

As we said, population is seeing a growth spike and to expect it to stop rising would be a pipe dream. At best, it may slow a little, but as ever, the trend is upwards. Despite government promises, the current housing shortage will continue,as supply can’t keep up with demand. In turn, we can expect tosee increased development and extensions of existing homes to cater for the ‘live with mum and dad’ 20 to 30-somethings, who simply can’t afford to move out.

+ Renting v buying

Wages not keeping pace with inflation has brought about an increasing new trend – to rent. The ‘Help to Buy scheme’ has benefitted some, but not the majority due to rising house prices quickly exceeding loan limits.

The trend of the decade

Over the next ten years, there will be more renters and less owners as house prices become out of reach of many average-earning families. As rented properties prove more popular, rents will rise significantly to be near (but not exceed) mortgage costs.

Furthermore, average occupancy will change to either single person or more than four – and not exclusively family. Low high rises of 3-4 floors will become the norm and off street parking will attract a premium.Proximity to public transport and other facilities will also increase in importance as the UK’s roads become more and more congested.