![]()

Almost £1,500 was added to the price of a typical three bedroom semi in March after an annual growth rate of 3.5 per cent; the £1,462 uptick pushed values up to £207,308 from £205,846 in February, showed the latest Nationwide BS index.

Tarlochan Garcha, of the peer-to-peer property lender Kuflink, said: “Despite the uncertainty thrown up by Brexit, and the headwinds of multiple tax changes and stricter lending criteria, the predicted property slump has simply not happened.

“These figures show house prices are stabilising despite a monthly and annual decrease in England.

“The acute lack of supply is steadily nudging up average prices and astute buyers are increasingly able to ask for, and secure, sizeable discounts.

“As increasingly stable house prices have proved over the last 12 months, ongoing resilience is the name of the property market’s game.”

However this was a fall of 0.3 per cent in March following a rise of 0.6 per cent in February and the first edge downwards in 19 months, found the society.

Economists believe a shortage of homes coming on to the market in the UK will bolster the market

It was the first fall on the mortgage lender’s index since June 2015 and surprised City economists who had forecast a 0.4 per cent increase in prices.

The housing market is expected to come under some pressure in 2017 as household finances are squeezed by a combination of rising inflation and weak wage growth, potentially deterring people from committing to major spending decisions.

However, economists believe a shortage of homes coming on to the market in the UK will bolster the market.

Howard Archer, UK chief at IHS Markit, said: “Markedly weakening consumer fundamentals, likely mounting caution over making major spending decisions, and elevated house price to earnings ratios are likely to weigh down on housing market activity and house prices.

“However, a shortage of supply is likely to put a floor under prices. Consequently, we believe house price gains over 2017 will be limited to around 2.5 per cent.”

Brian Murphy, head of lending at the Mortgage Advice Bureau, said a cooling of the UK housing market might enable more people to get on to the housing ladder.

“A slowing down of prices coupled with the ongoing near record low mortgage rates available may provide a welcome opportunity for those who want to get on to or move up the property ladder to take advantage of the current climate.

“Given that home ownership levels are at their lowest since the mid-80s, then any market conditions which may assist more people to buy their own property could be seen as a positive development, rather than a cause for concern.”

Looking at trends over the past decade, the Nationwide said home ownership in England was at the lowest level since 1985, at 62.9 per cent in 2016. Ownership rates among those aged 35-44 fell sharply to 56 per cent from 74 per cent in 2006.

The housing market is expected to come under some pressure in 2017

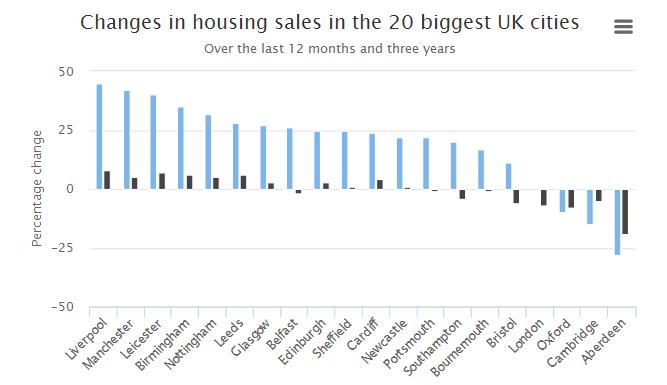

Over the first quarter, there was the least variation in regional house price performance in almost 40 years.

At 6.8 percentage points, the gap between the weakest and strongest performing regions was the lowest since 1978.

Robert Gardner, Nationwide’s chief economist said: “The south of England continued to see slightly stronger price growth than the north of England, but there was a further narrowing in the differential.

“Northern Ireland saw a slight pickup in annual house price growth, while conditions remained relatively subdued in Scotland and Wales.”