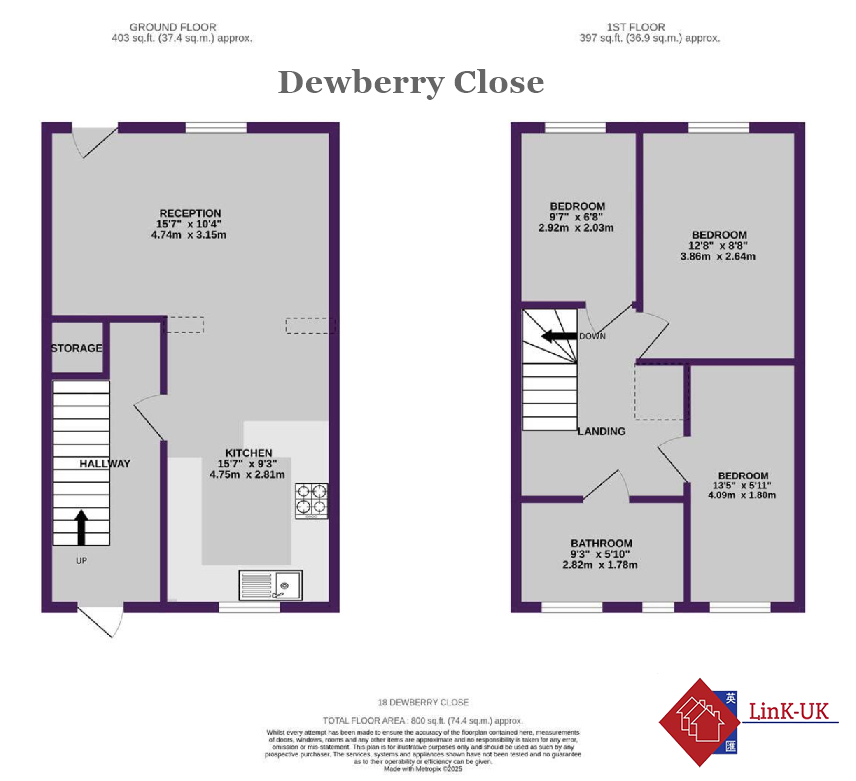

Upstairs, the property features two generously sized double bedrooms, and a well-appointed family

bathroom. The layout is both practical and stylish. The bright and welcoming ‘entrance hallway’ leads you outside and you’ll find a private, low-maintenance rear garden with decking – ideal for summer dining, entertaining, or simply enjoying a peaceful moment outdoors. The paved area to the rear of the garden captures the fading evening sun.

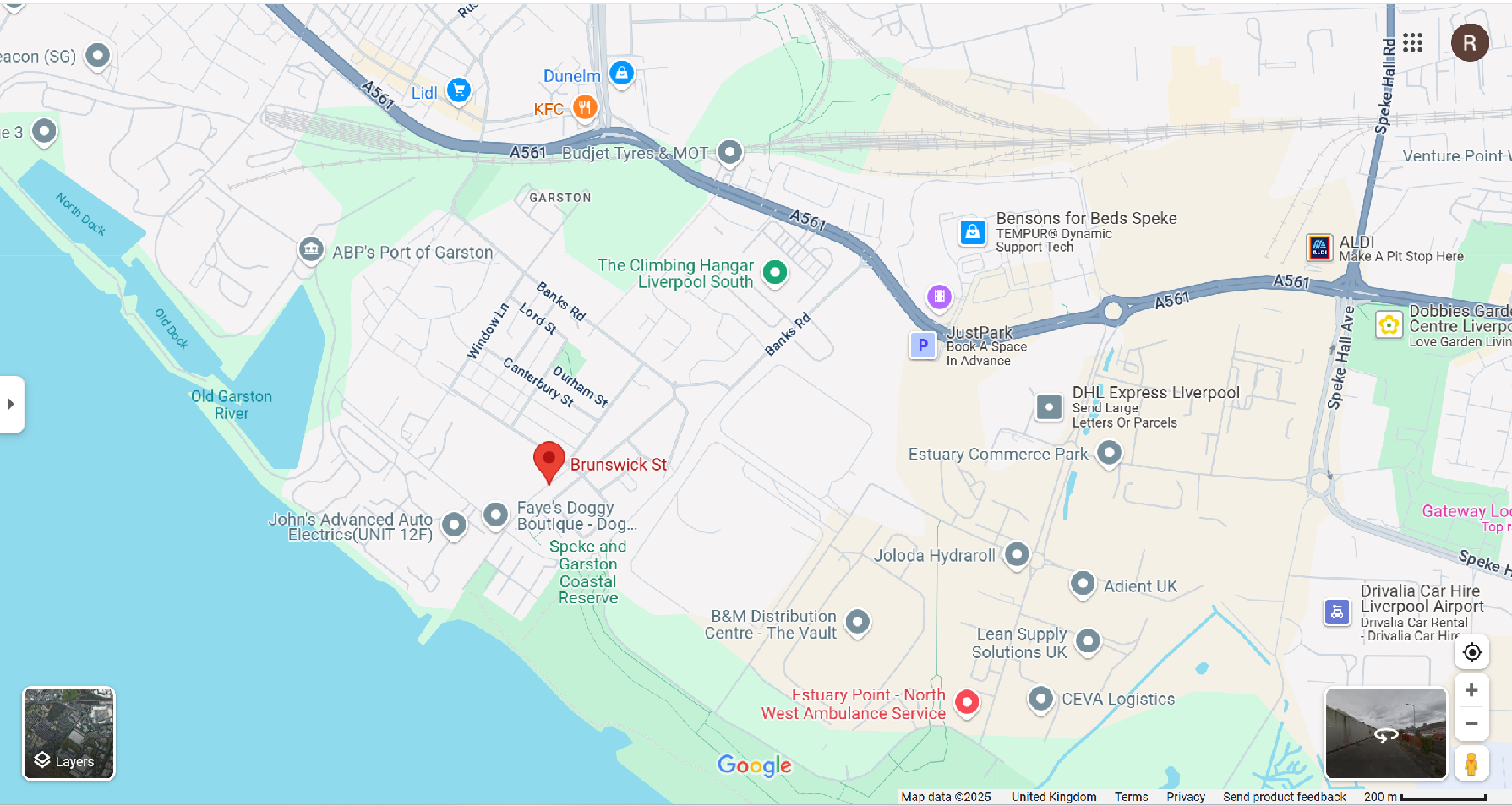

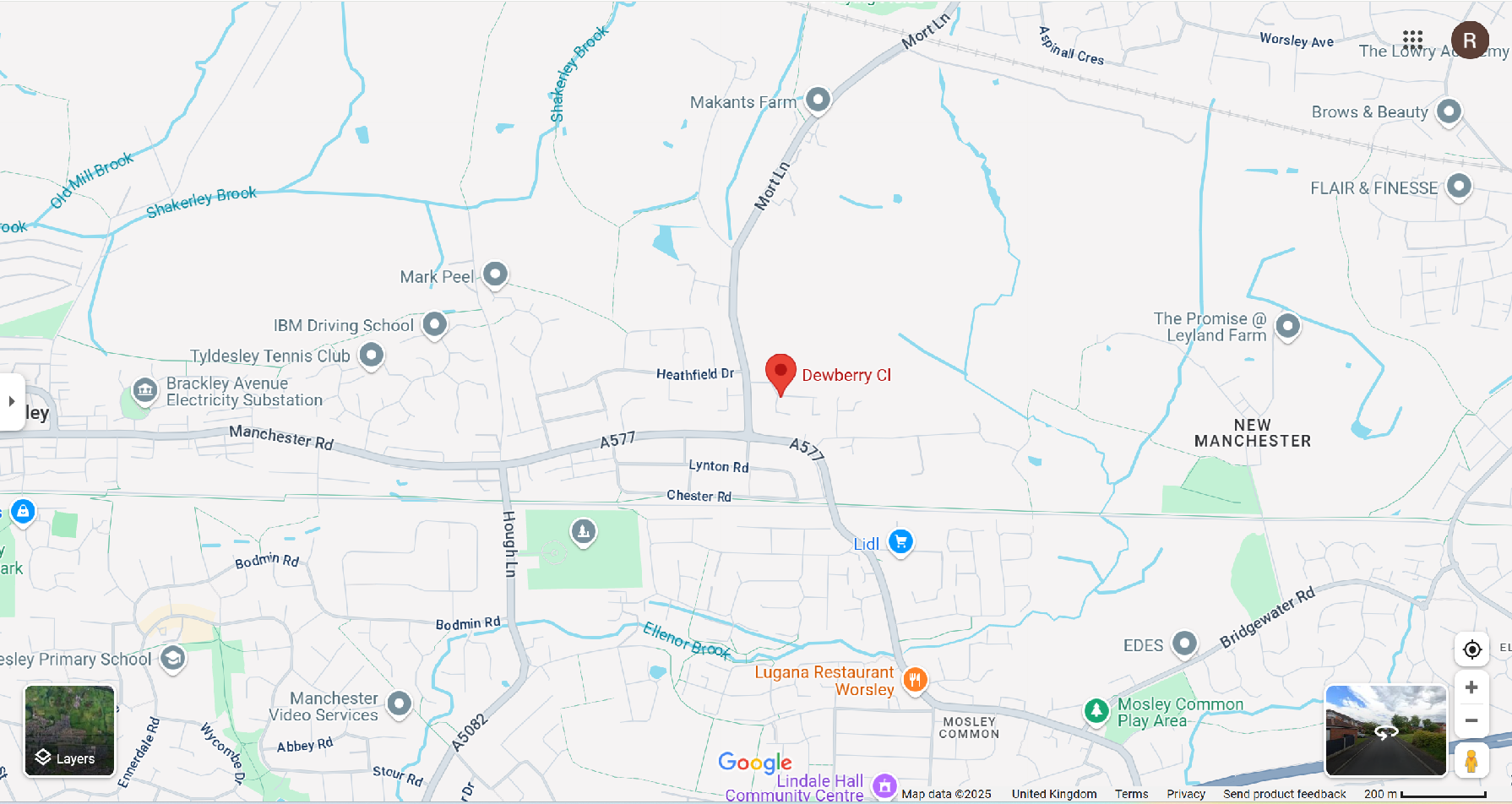

Excellent local transport links including Cressington and Liverpool South Parkway stations. Close to popular schools, parks, shops and amenities. Located just a short distance from Liverpool John Lennon Airport, and The Speke Garston Coastal Reserve. 96% White and situated in a low crime rate street area.

2 Bedroom Terraced House – £170,000

Distance:

- Liverpool South Parkway Train Station – 0.7 mile away (13 mins walk)

- Banks Road (Primary School) – 230 yards away (Good grade)

- The Academy of St Nicholas (Secondary School) – 0.5 mile away (Good grade)

- Rosebuds (Day Nursery) – 0.3 mile away (5 mins walk)

- Daily Shop (Supermarket) – 0.4 mile away (7 mins walk)

- New Mersey (Shopping Centre) – 1 mile away

- Speke & Garston Coastal Reserve (Park) – 0.2 mile away (4 mins walk)

- The Village (Medical Practice) – 0.5 mile away

- Spire Liverpool (Hospital) – 2.9 miles away

Unit:

- 2 Bedrooms

- 1 Bathroom

- 1 Living Room

- 1 Living/dining Room

- 1 Kitchen

- 1 Entrance Hallway

- 2 Gardens

For more information, please call Eric Yip @(852) 9106 5235 / Whatsapp @(852) 5717 3542

Link-UK (“The Company”) deals exclusively in relation to properties outside Hong Kong. The company is therefore not required to be licensed under the Estate Agents Ordinance and does not deal with any property situated in Hong Kong.