![]()

Chinese apartment buyers shift from Australia to UK

Regulators crack down on foreign lending amid fears of property price bubble

February 26, 2017

by: Jamie Smyth in Sydney and Yuan Yang in Beijing

Zhang Biao, a 32-year-old Chinese entrepreneur, has already thought about where his eight-year old will go to university. “We thought a flat overseas would be a good investment, and our son could use it for sixth form or university in Australia or the UK,” he says.

Mr Zhang and his wife put an offer down on a A$600,000 (US$460,000) flat in Melbourne in October, only to be told that they were no longer eligible for the 60 per cent loan-to-value mortgage they had applied for. Instead they decided to pay up front for a £120,000 flat in the English city of Liverpool. Mr Zhang is one of a growing number of Chinese property investors switching their focus from Australia to other markets as regulators — eager to moderate rapidly rising prices amid fears of a bubble — have increased pressure on banks to curb foreign lending.

This month, the Reserve Bank of Australia warned that residential building activity had been 50 per cent higher than long-term averages for two years and there was a risk that “newly completed apartments fail to settle”. A sharp correction in the property market could tip Australia into its first recession in a quarter of century, analysts warn. Gross domestic product contracted in the third quarter by 0.6 per cent, although most economists expect economic growth should resume in the fourth quarter. “We believe the [property market] correction will start with settlement problems for low quality apartments,” said broker CLSA in a recent report. “Our worst-case scenario would result in dwelling prices falling in all areas, eventually leading to a recession.”

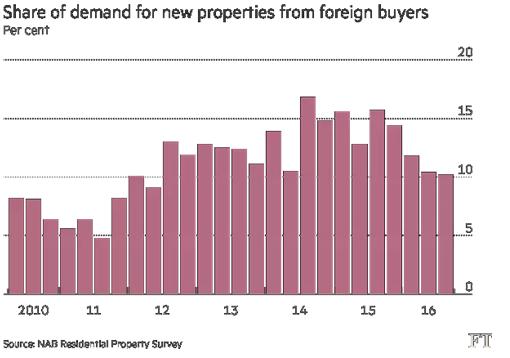

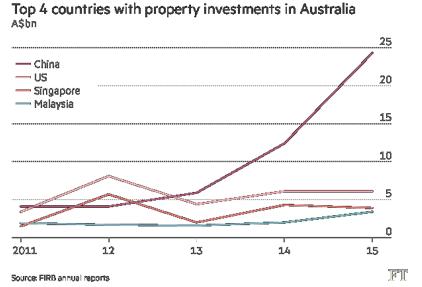

The boom in foreign property investment has helped the Australian economy to continue growing despite sharp falls in mining investment. In 2014-15 Chinese investors were granted approval to spend A$24.3bn on property, more than three times the value of purchases from the US, the second largest group of foreign investors. The inflow of foreign capital helped push prices up in Sydney and Melbourne, the two biggest cities, by 67 per cent and 47 per cent respectively, over the past four and a half years. Foreign buyers account for one in five apartment sales. Now overseas demand is starting to weaken. Over the past two years the proportion of new property sales accounted for by foreign buyers in Australia has fallen from 16.8 per cent to 10.9 per cent. This drop is particularly felt in the apartment market. Building approvals for apartments fell by a fifth in the year to end-December. Unit prices have begun to moderate in Melbourne and Brisbane, edging up by only 1.7 per cent and 2.3 per cent respectively last year. “Chinese buyers are increasingly nervous about Australia because of recent instability in regulation, tax and bank lending rules,” says Esther Yong, co-founder of ACproperty, a Chinese language property portal. “A lot of Chinese who bought apartments off-plan three years ago are now finding it difficult to find finance as Australian banks have blocked lending to foreign buyers.”

The big four Australian banks — NAB, Commonwealth Bank of Australia, ANZ and Westpac — have all stopped issuing loans to non-resident borrowers with no domestic income. “We have essentially shut down mortgages to non-resident buyers,” Shayne Elliott, ANZ’s chief executive, told the Financial Times. He said the apartment market in Melbourne was “a little bit concerning” due to the proliferation in the city centre of small apartments, some under 50 square metres in size and with no bedroom windows. The withdrawal of bank financing has forced some property developers to ramp up vendor financing, which can leave buyers exposed if prices then fall. Meriton, Australia’s biggest apartment builder, offers buyers two-year loans, providing them with some breathing space to find alternative financing. “Our loan book has doubled over the last 12 months to about A$120m as the rule changes have left some foreign buyers in limbo,” said James Sialepis, sales director at Meriton, Australia’s biggest apartment builder. Other developers have begun offering discounts and rental guarantees on some properties. Increasingly, Chinese buyers are looking elsewhere. ACproperty recently teamed up with property listing company Listglobally, to launch a Mandarin language housing site called Sodichan.com focused on other international markets. “Our agents in China have been asking us to supply them with properties in other countries,” said Ms Yong. She said the UK had become popular after the Brexit vote because the fall in the value of sterling had made it cheaper for Chinese buyers. But Beijing’s tough new capital controls are making it more difficult to move large amounts of cash out of China. Foreign property investments by Chinese companies plunged by 84 per cent last month, according to the Chinese Ministry for Commerce. “For some Chinese buyers who have family connections in Australia, they will continue to buy there. But for others without these specific reasons, they will look at other opportunities,” said Ms Yong.